Home Warranties: What’s Covered and How They Work

Home Warranties: What’s Covered and How They Work

A home warranty can be an essential tool for homeowners, providing a safety net for unexpected repairs and maintenance costs. Understanding how home warranties work and what they cover can save you money and stress in the long run. This article will explore the ins and outs of home warranties, including what they cover, how they operate, and tips for selecting the right one for your needs.

Understanding Home Warranties

The Basics of Home Warranties

A home warranty is a service contract that covers the repair or replacement of major home systems and appliances that may break down due to wear and tear. Unlike home insurance, which covers damage from external factors like storms or fires, home warranties focus on fixing systems and appliances that malfunction as part of their normal operation.

Typically, home warranties are offered for a year and can be renewed annually. They provide peace of mind for homeowners, especially those who may not have the budget for unexpected repairs. Most home warranty companies provide a detailed list of what's covered, along with terms and conditions that may affect your service.

It's important to note that not all home warranties are created equal. Different providers may offer varying levels of coverage, and some may include additional benefits such as discounts on future services or coverage for optional items like pools or spas. Homeowners should carefully review the fine print and consider their specific needs before selecting a warranty plan, as this can greatly influence their satisfaction and overall experience.

Importance of Home Warranties

Having a home warranty can significantly lighten the financial burden of maintaining a home. It protects homeowners from costly repairs and gives them the security of knowing they won’t have to face unexpected expenses alone.

Moreover, home warranties can add value when selling a house. Potential buyers often feel more comfortable purchasing a home that comes with a warranty, knowing their investment is somewhat protected. This can make your home more appealing in a competitive market.

Additionally, a home warranty can streamline the repair process. When a system or appliance fails, homeowners can simply contact their warranty provider, who will then dispatch a qualified technician to assess the issue. This not only saves time but also alleviates the stress of finding a reliable repair service. Furthermore, many warranty companies have established relationships with local contractors, ensuring that repairs are handled efficiently and to a high standard, which can be particularly beneficial in urgent situations.

What's Covered Under a Home Warranty?

Coverage for Appliances

Home warranties typically cover a range of appliances, including refrigerators, dishwashers, ovens, washers, and dryers. Coverage often extends to issues such as mechanical failures and can include repairs or replacement costs. This can be especially beneficial for first-time homeowners who may not have the budget to handle unexpected appliance breakdowns.

Contract specifics can vary by provider, so it’s essential to read through the details. Some plans even offer additional options for coverage on specialty items like wine coolers or standalone freezers. Additionally, many home warranty companies provide 24/7 customer service, allowing homeowners to report issues at any time, which can be a lifesaver during a weekend or holiday when an appliance fails.

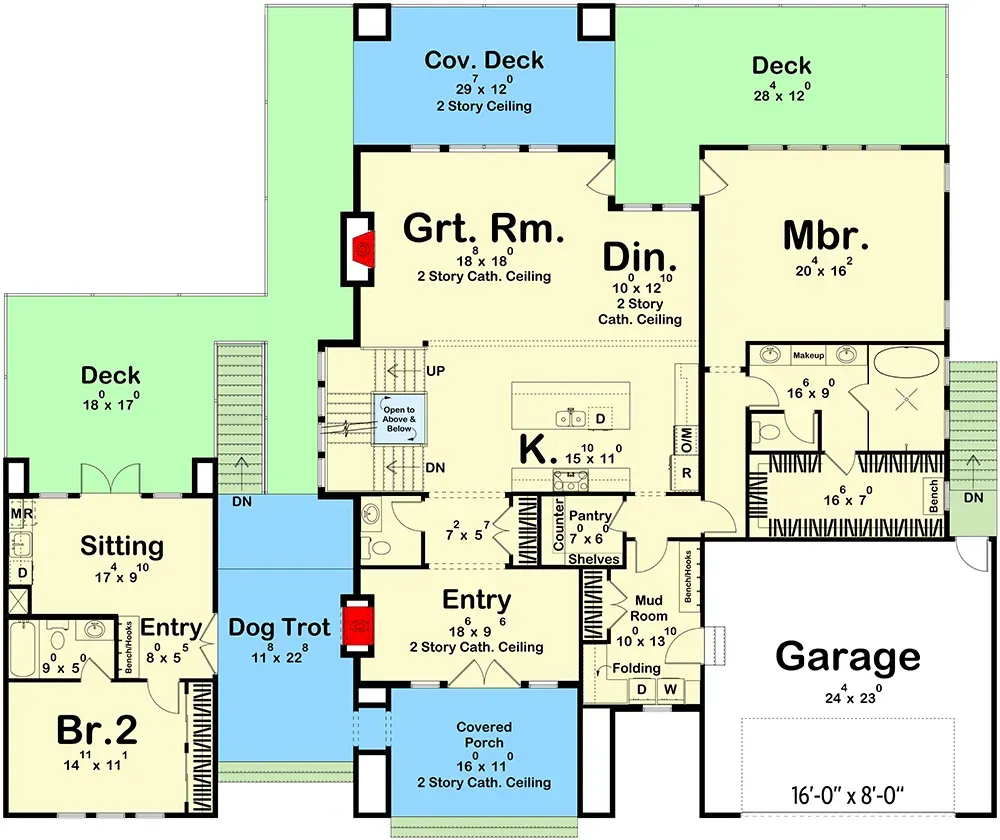

Coverage for Systems

In addition to appliances, home warranties generally cover essential home systems such as heating, ventilation, and air conditioning (HVAC), plumbing, electrical systems, and water heaters. For many homeowners, these systems can be quite costly to repair or replace if they fail unexpectedly. Regular maintenance of these systems can prolong their lifespan, but when issues do arise, having a warranty can alleviate the financial burden.

Ensuring that these critical systems are included in your home warranty can prevent significant out-of-pocket expenses and provide peace of mind. Some providers even offer optional add-ons for more comprehensive coverage, such as pool and spa equipment or septic systems, which can be particularly advantageous for homeowners with unique needs.

Coverage Limitations and Exclusions

While home warranties can be incredibly beneficial, it's crucial to understand that they often have limitations. Most warranties do not cover pre-existing conditions, maintenance neglect, or damages caused by improper installation. For example, if a homeowner neglects routine maintenance on their HVAC system, a warranty provider is likely to deny a claim for a breakdown. This highlights the importance of keeping thorough records of maintenance and repairs.

Furthermore, certain items might be excluded altogether. Common exclusions include refrigerators over ten years old or minor repairs that fall below a specified threshold. Always review the contract's fine details to understand potential gaps in coverage. Some plans may also have caps on the amount they will pay for certain repairs, meaning homeowners could still face costs even with a warranty in place. Being informed about these limitations can help homeowners make better decisions regarding their warranty options and budget for potential out-of-pocket expenses.

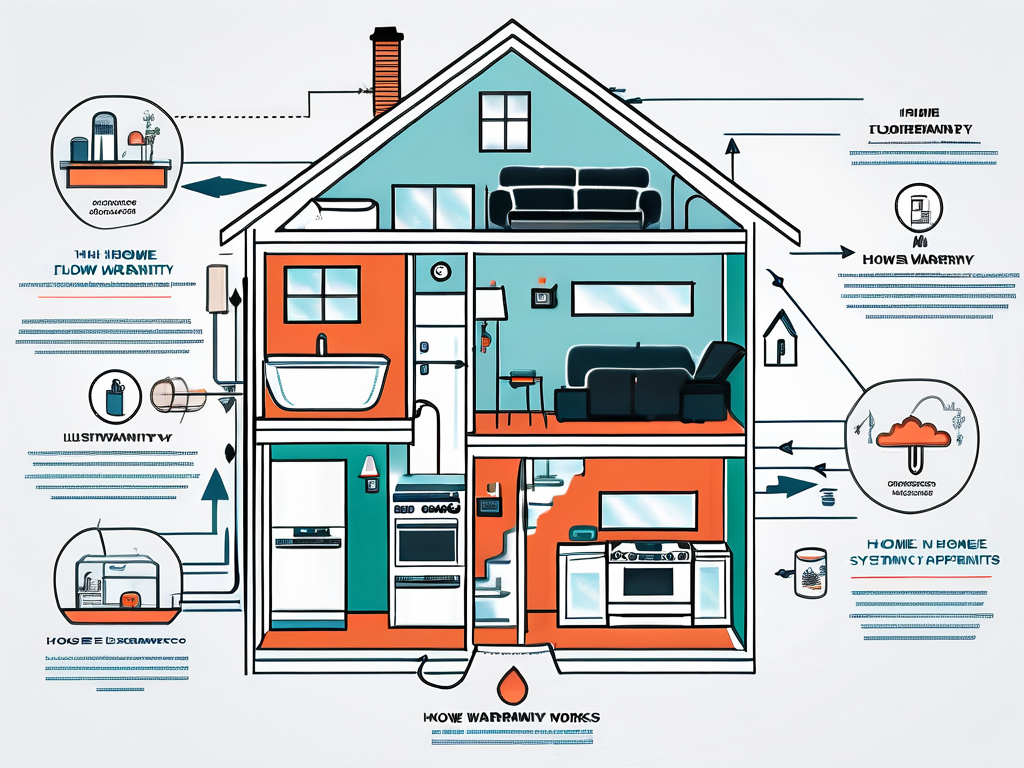

How Does a Home Warranty Work?

The Process of Claiming a Home Warranty

When a covered item fails, the homeowner submits a claim to the home warranty provider. This process usually involves calling a designated hotline or filling out an online form. After the claim is submitted, the warranty company will assign a licensed contractor to assess the problem and determine the necessary repairs.

Once the issue is evaluated, the contractor will either repair the item or communicate if a replacement is necessary. Homeowners generally pay a service fee for each claim, which varies depending on the provider; this fee usually ranges between $50 and $125. It's important for homeowners to keep a detailed record of all communications and repairs, as this documentation can be crucial if disputes arise regarding coverage or service quality.

Moreover, many home warranty companies offer a 24/7 claims service, allowing homeowners to report issues at any time, which can be particularly beneficial during emergencies. This accessibility ensures that homeowners can receive timely assistance, minimizing the inconvenience caused by a malfunctioning appliance or system.

Costs Associated with Home Warranties

The total cost for a home warranty can vary widely, with annual fees typically ranging from $300 to $600, depending on the coverage options selected. Additionally, homeowners should remember to factor in the service fees associated with each claim, as these costs can add up if multiple claims are made throughout the year.

Investing in a home warranty can still be advantageous even with these costs, especially compared to paying out-of-pocket for unexpected repairs. For instance, the average cost to repair a major appliance can often exceed the annual premium of a home warranty, making it a financially sound choice for many homeowners. Furthermore, some providers offer customizable plans that allow homeowners to select coverage specific to their needs, which can enhance the value of the warranty and ensure that critical systems are protected.

Home warranties can also provide peace of mind, particularly for first-time homeowners who may not have experience with home maintenance and repairs. Knowing that help is just a phone call away can alleviate the stress associated with homeownership, allowing individuals to enjoy their new space without the looming worry of unexpected repair costs. Additionally, many home warranty companies offer online resources and customer support to help homeowners understand their coverage options better, further enhancing the overall experience.

Choosing the Right Home Warranty

Factors to Consider When Selecting a Home Warranty

When searching for the perfect home warranty, consider factors like coverage options, the reputation of the warranty provider, customer service, and reviews from other homeowners. It’s also beneficial to clarify the types of systems and appliances covered and any limits that apply to those items.

Partnering with a reputable company, such as TurnKey Homes, can provide an enhanced sense of reliability. They can offer insights into tailored plans that suit individual needs, ensuring you are well-informed before making a purchase.

Common Misconceptions About Home Warranties

One common misconception is that home warranties are the same as homeowners insurance; however, these are two completely different products that serve different purposes. Another myth is that warranties cover everything in the home. In reality, many items are excluded from most plans.

Moreover, many homeowners believe claims will be paid without question; however, it's crucial to understand the claims process and abide by the terms of the agreement to avoid claim denials.

The Pros and Cons of Home Warranties

Benefits of Having a Home Warranty

The primary benefit of having a home warranty is financial security. Homeowners can budget for the annual fee and service costs, knowing they have a safeguard against unexpected expenses. Additionally, home warranties simplify the repair process, as homeowners can rely on pre-approved contractors to handle issues.

Moreover, a warranty can enhance a property's market value, making it more appealing to potential buyers.

Potential Drawbacks of Home Warranties

On the flip side, one of the main drawbacks is that homeowners sometimes find the claims process cumbersome and may face disputes over coverage. Additionally, improper maintenance can lead to denied claims, and not all systems and appliances are covered equally.

Therefore, it is essential to weigh the pros and cons carefully and ensure a home warranty aligns with your needs and expectations.

Article Summary

- A home warranty provides coverage for repairs or replacements of home systems and appliances.

- Understanding coverage limits and exclusions is essential for maximizing warranty benefits.

- The claims process can be straightforward if homeowners understand their contracts.

- Choosing a reliable provider like TurnKey Homes can enhance the warranty experience.

- Weighing the pros and cons is vital when considering a home warranty.

Let’s talk about your project

Fill out the form, or call us to set up a meeting at

We will get back to you as soon as possible.

Please try again later.